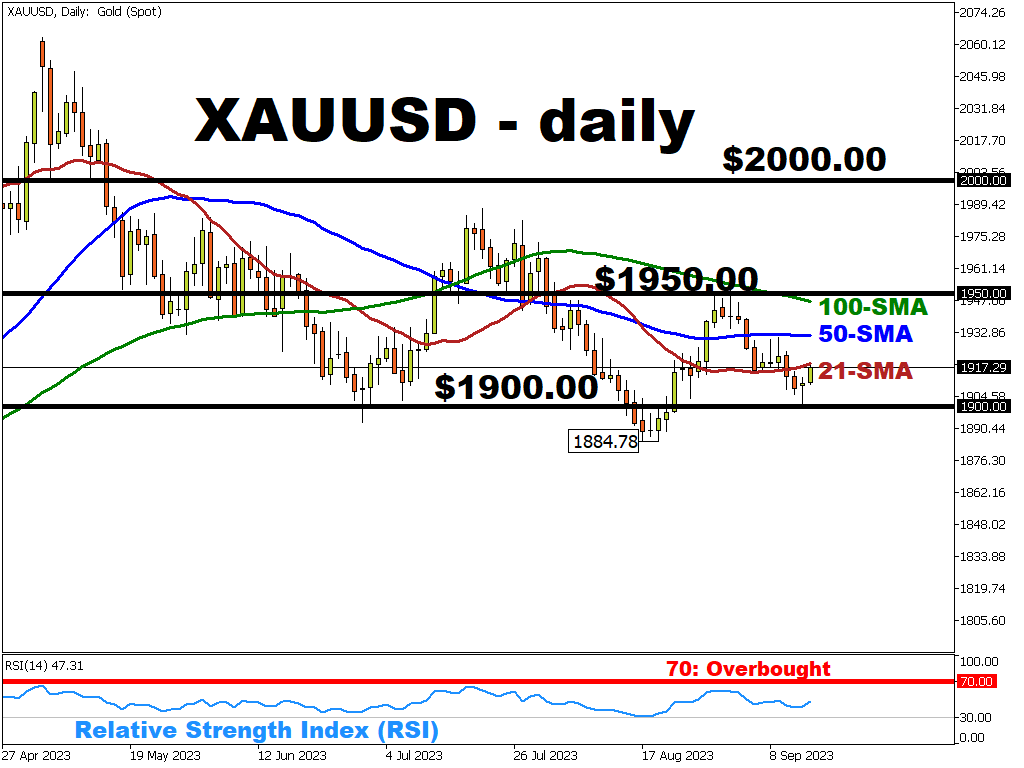

XAUUSD rebounds off $1900

The gold prices have decreased towards the psychologically important $1900 amid a mixed CPI reading last Wednesday. A recent uptick in the headline consumer price index (CPI) may indicate the potential for another rate hike towards the end of 2023.

As of today, the market expects a 32.6% chance of another rate hike at the Fed’s meeting in November.

A further increase in rates may deter the XAUUSD bulls from resurfacing above the $1950 round number, temporarily capping the gold’s upside potential.

During the past week the investors have already withdrawn ~$979 million worth of shares from the world’s largest gold-backed exchange traded fund (ETF).

From a technical perspective the 21-period SMA is set to act as an immediate resistance at $1919.

To the downside, the psychologically important $1900 might provide a strong support if XAUUSD bears try to carry on with the downward momentum.

Latest reviews

There's a better website for you

A new exciting website with services that better suit your location has recently launched!

Sign up here to collect your 30% Welcome Bonus.