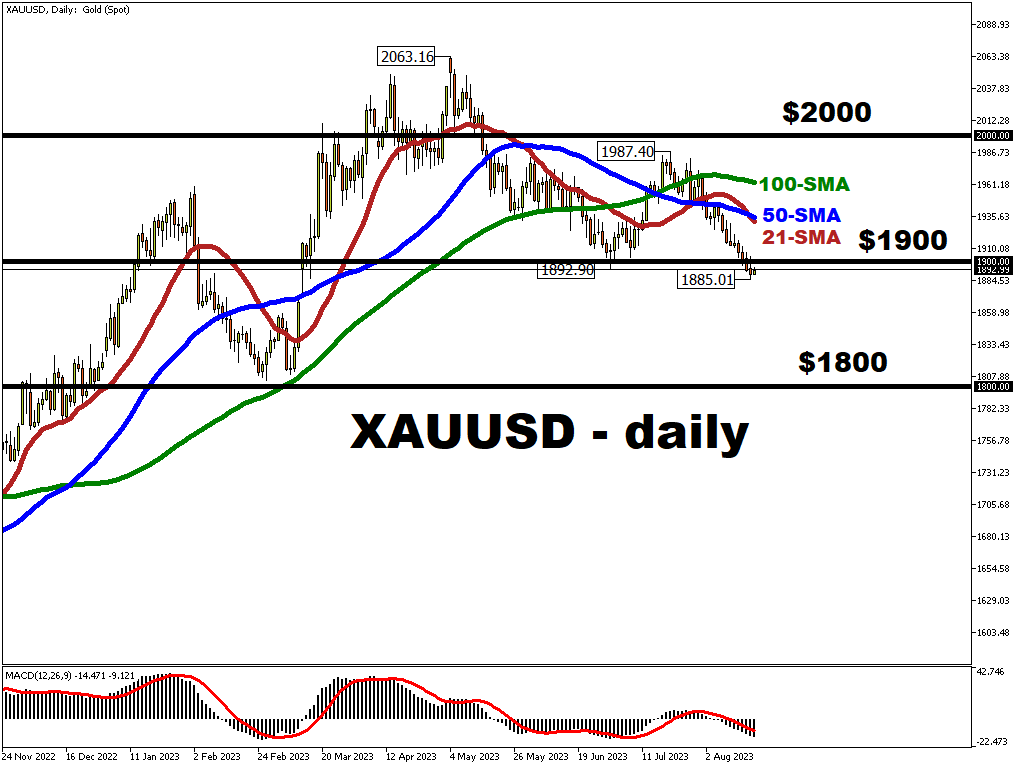

XAUUSD struggles below $1900

Gold continues to remain under pressure and trades below the key $1900 psychological level, hitting a five-month low at $1889.59 on Thursday.

China’s murky prospects of economic recovery along with the recent robust US economic performance are putting significant pressure on XAUUSD bulls. 10-year US Treasury yields have reached a 10-month high, strengthening the dollar and making some investors reconsider their current gold positions.

Any macro indication in support of a rate hike at the next Fed meetings will add additional pressure on XAUUSD, with the potential to drive it lower towards the $1800 psychological level.

From a technical perspective we might expect XAUUSD to consolidate around the $1900 big figure as investors await signals which could potentially affect the Fed’s future interest rate decision.

At the time of writing, the CME FedWatch Tool indicates an 86.5% chance of interest rates remaining unchanged at 5.25% - 5.5%. during the next Fed decision in September.

The $1900 level is set to be initial resistance, while the 21-day SMA moving under the 50-day SMA indicates the potential for a further decline.

Latest reviews

There's a better website for you

A new exciting website with services that better suit your location has recently launched!

Sign up here to collect your 30% Welcome Bonus.