Gold may revisit $1900 on more Fed hawkishness

Gold has been dragged lower this week as markets elevate bets for one more 25-basis point Fed rate hike by November.

Gold’s allure as a safe haven has been eroded after US default risk was negated and US banking turmoil subsided, amidst a US economy that has proven more resilient than expected.

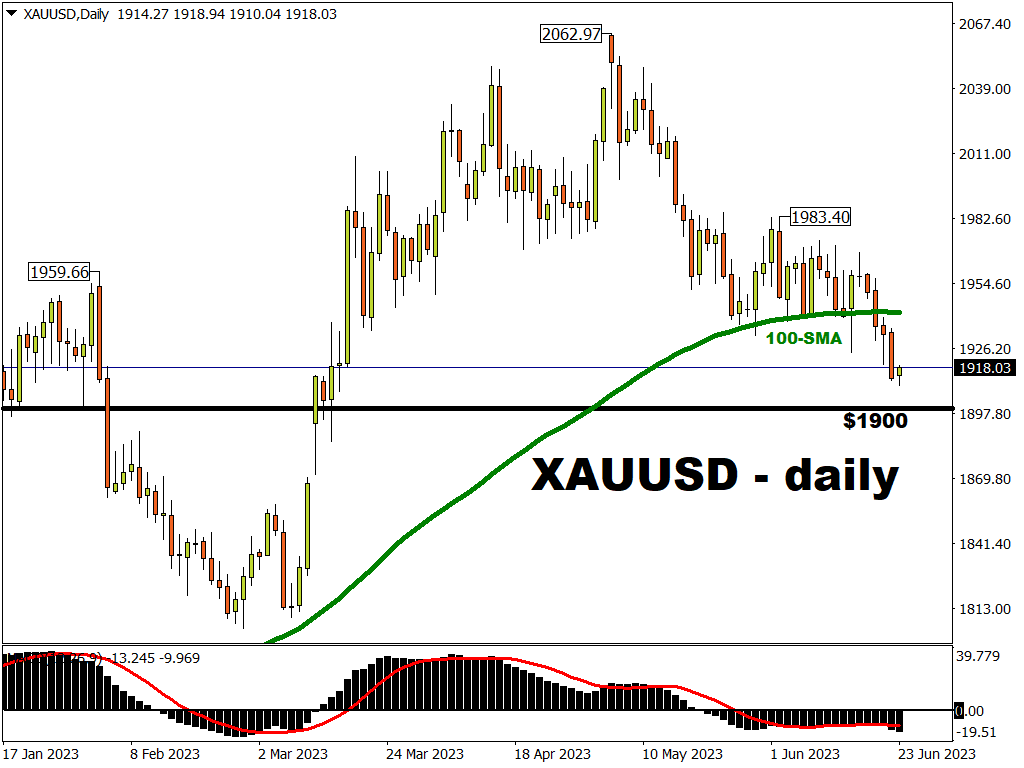

From a technical perspective, the fact that spot gold was dragged below its 100-day simple moving average, which had been served as a crucial support level since late May, may be perceived as a strong bearish signal.

Gold markets could be rocked by Fed Chair Jerome Powell’s comments due coming Wednesday at the ECB’s forum. Friday’s release of the Fed’s preferred inflation gauge, the PCE deflator, may also prove to be a major catalyst for gold traders.

Spot gold may revisit sub-$1900 levels in the near-term if markets begin to expect yet another Fed rate hike this year.

Such odds may be raised if markets finally do take heed of Powell’s hawkish messaging, coupled with another stronger-than-expected PCE deflator print in the week ahead.

Latest reviews

There's a better website for you

A new exciting website with services that better suit your location has recently launched!

Sign up here to collect your 30% Welcome Bonus.