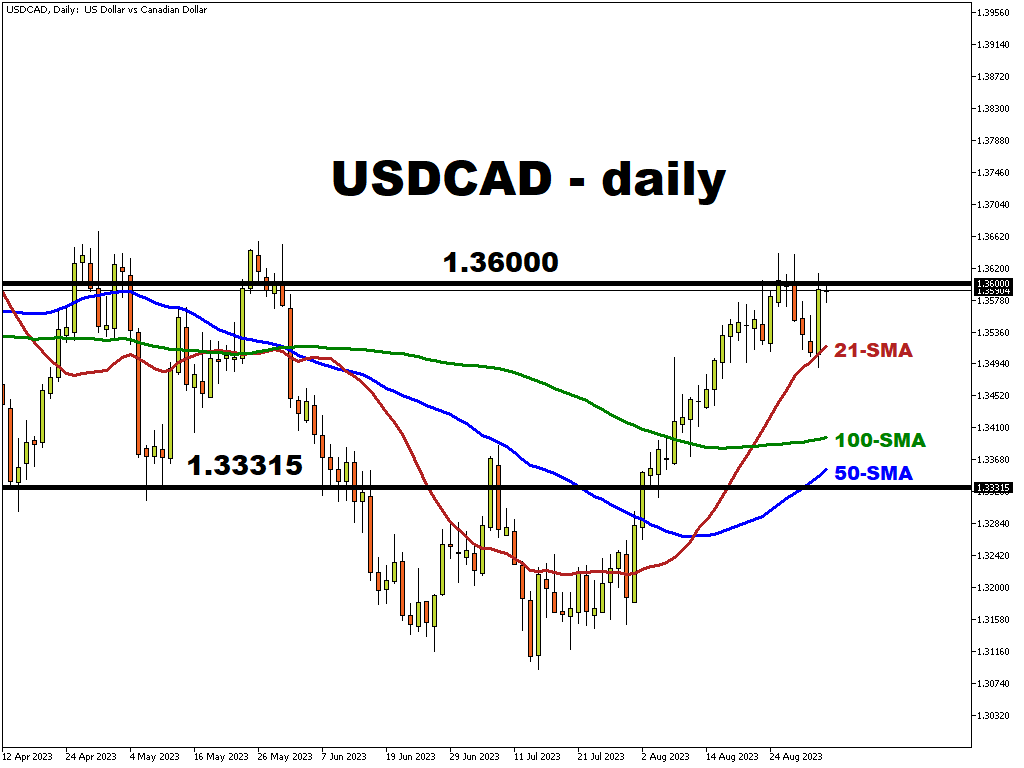

This Week: USDCAD tests 21-preiod SMA

The recent downbeat risk backdrop and failing Chinese economic recovery has hurt cyclical currencies like the loonie. It was the third worst performing major last month after the aussie and kiwi.

Lower commodity prices in August also account for a good part of the headwinds around CAD, though the recent jump in crude prices could act as support.

Technically, USD/CAD rose for seven straight weeks through July and August. Recent choppy price action hints that the rally may find it harder to advance above 1.36. The April and May peaks just above 1.3650 act as resistance. Support sits around 1.3510 with the 200-day SMA at 1.3461.

Events Watchlist

- Wednesday, September 5th: RBA Rate Decision

Consensus sees the RBA keeping rates unchanged at 4.10%. Data since the last meeting has been constructive with cooling price growth and a rising jobless rate. Risks still remain around the labour market and wage growth. But the bank will likely want to assess the cumulative impact of its tightening cycle.

- Wednesday, September 6th: Bank of Canada Rate Decision

The Bank of Canada is expected to hold its key interest rate steady at 5% and stay at that level until the end of March 2024, according to a majority of economists in a Reuters poll. The BoC has lifted rates ten times since March 2022. The softening labour market and GDP growth are key factors in the bank standing pat.

- Friday, September 8th: Canada Employment

The most recent jobs numbers saw the unemployment rate tick up to 5.5% while the economy unexpectedly shed jobs. That made it two out of the previous three months that jobs have been lost. The labour market had until then been resilient, supported in part by strong immigration. But higher borrowing costs now seem to be impacting the economy.

Here’s comprehensive list of other key economic data and events due this week:

Monday, September 4

- CHF: GDP s.a. QoQ (Q2)

- EUR: Germany’s Trade Balance s.a. (Jul)

- AUD: S&P Global Composite & Services PMI (Aug)

Tuesday, September 5

- CNY: Caixin Services PMI (Aug)

- AUD: Interest Rate Decision & RBA Rate Statement

- EUR: EU’s producer Price Index MoM & YoY (Jul); HCOB Composite & Services PMI (Aug)

- USD: Factory Orders MoM (Jul)

Wednesday, September 6

- EUR: Retail Sales YoY (Jul)

- CAD: Interest Rate Decision & BoC Rate Statement

- AUD: RBA’s Governor Lowe speech & GDP QoQ & YoY (Q2)

- USD: Fed’s Beige Book

Thursday, September 7

- AUD: Trade Balance MoM (Jul)

- CNY: Trade Balance CNY & USD (Aug)

- EUR: EU’s GDP s.a. QoQ & YoY (Q2)

- CAD: BoC’s Governor Macklem speech

- JPY: GDP QoQ (Q2)

- GBP: BoE Monetary Policy Report Hearings

Friday, September 8

- EUR: Harmonized Inde of Consumer Prices YoY (Aug)

- CAD: Unemployment Rate (Aug) & Net Change in Employment (Aug)

- USD: Baker Hughes US Oil Rig Count

Latest reviews

There's a better website for you

A new exciting website with services that better suit your location has recently launched!

Sign up here to collect your 30% Welcome Bonus.