This Week: US CPI, Truce deadline, Trump-Putin talks

- RBA expected to cut rates by 25bp on Tuesday

- US CPI report + US-China truce deadline = volatility?

- USDInd: Over past year US CPI triggered moves of ↑ 0.3% & ↓ 0.4%

- Key UK data on Thursday to influence GBPUSD outlook

- Trump scheduled to meet Putin in Alaska on Friday

All eyes will be on the RBA rate decision, US inflation, the expiration of a preliminary US-China trade truce and a meeting in Alaska between the US and Russian presidents.

The RBA is expected to cut rates on Tuesday, while the US CPI report could influence Fed policy expectations in the face of Trump’s tariffs. Investors will be observing whether the United States and China extend a 90-day tariff truce. Trump plans to meet Russian President Vladimir Putin in Alaska in an effort to secure a deal to end the war in Ukraine.

Event Watchlist:

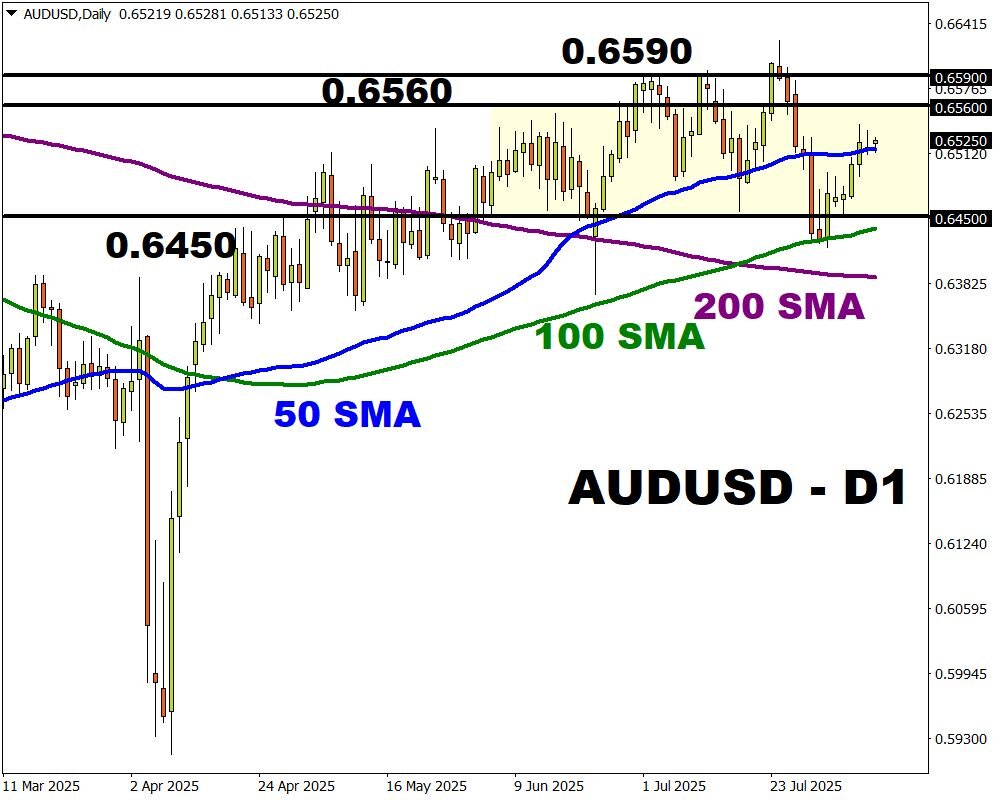

AUDUSD

The Reserve Bank of Australia is expected to cut interest rates by 25 basis points on Tuesday. So, investors will be seeking clues about future policy moves. Should the RBA signal further cuts in 2025, this may weigh on the AUDUSD – opening a path toward 0.6450. A hawkish-sounding RBA may push the currency pair toward 0.6560.

USDInd

The USDInd could see heightened levels of volatility if the incoming US CPI report influences Fed cut bets. A 90-day trade truce between the US and China expires on Tuesday. Without an extension, the US could reimpose 145% tariffs on Chinese goods, and Beijing might reinstate its 125% duties on US goods.

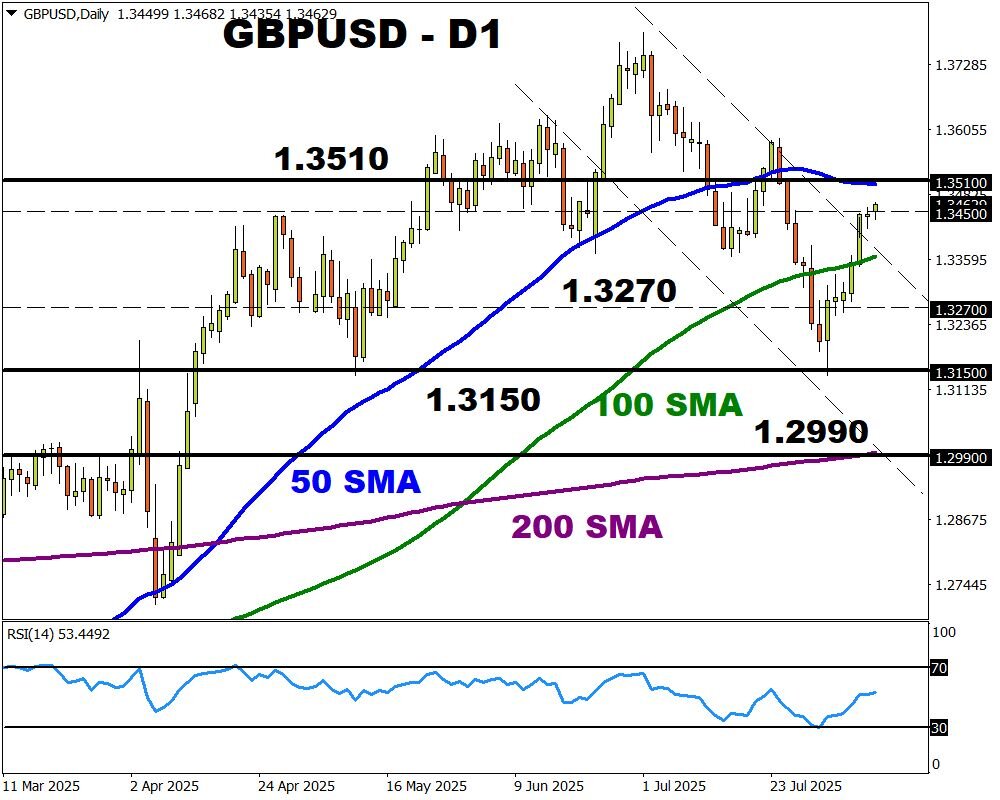

GBPUSD

After the BoE rate cut in August, traders are pricing in a 50% probability of another rate cut by November. The latest UK GDP and industrial production figures are likely to influence these bets, ultimately impacting the GBPUSD. Prices are turning bullish on the daily charts with key levels of interest at the 50-day SMA, 1.3450 and 100-day SMA.

Here’s a detailed list of other key economic data and events due this week:

Monday, 11th August

- MXN: Mexico industrial production

- ZAR: South Africa manufacturing production

Tuesday, 12th August

- AUD: RBA rate decision

- GER40: Germany ZEW survey expectations

- ZAR: South Africa unemployment, mining output

- OIL: OPEC monthly oil market report.

- GBP: UK employment

- USDInd: US CPI, Richmond Fed President Tom Barkin speech

- Preliminary trade truce between the US and China expires

Wednesday, 13th August

- CHINAH: Tencent earnings

- GER40: Germany CPI

- JP225: Japan PPI

- ZAR: South Africa retail sales

- USDInd: Atlanta Fed President Raphael Bostic speech

Thursday, 14th August

- CHINAH: JD.com earnings

- AUD: Australia unemployment

- EUR: Eurozone GDP, industrial production

- UK100: UK industrial production, GDP

- US500: US PPI, initial jobless claims, Richmond Fed President Tom Barkin speech

Friday, 15th August

- Trump-Putin talks in Alaska

- CAD: Canada manufacturing sales, existing home sales

- CN50: China retail sales, industrial production, fixed asset investment

- JPY: Japan industrial production, GDP

- NZD: New Zealand food prices, BusinessNZ manufacturing PMI

- USDInd: US retail sales, University of Michigan consumer sentiment, industrial production, Empire State manufacturing