This Week: Three major central bank decisions

- Central banks steer FX with key rate holds this week

- RBA likely holds; sticky inflation props AUD tone

- BoC likely holds; uneven growth keeps stance cautious now

- Fed decision guides USD as markets eye easing path

- China, Europe, UK, US data fill a packed econ week

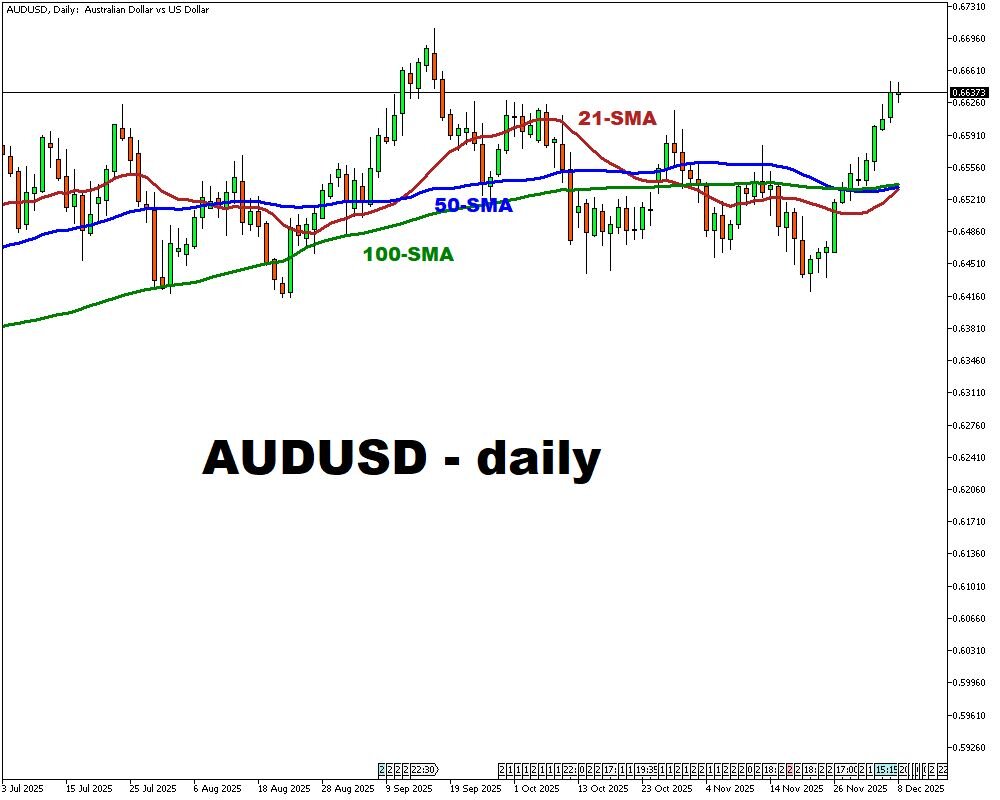

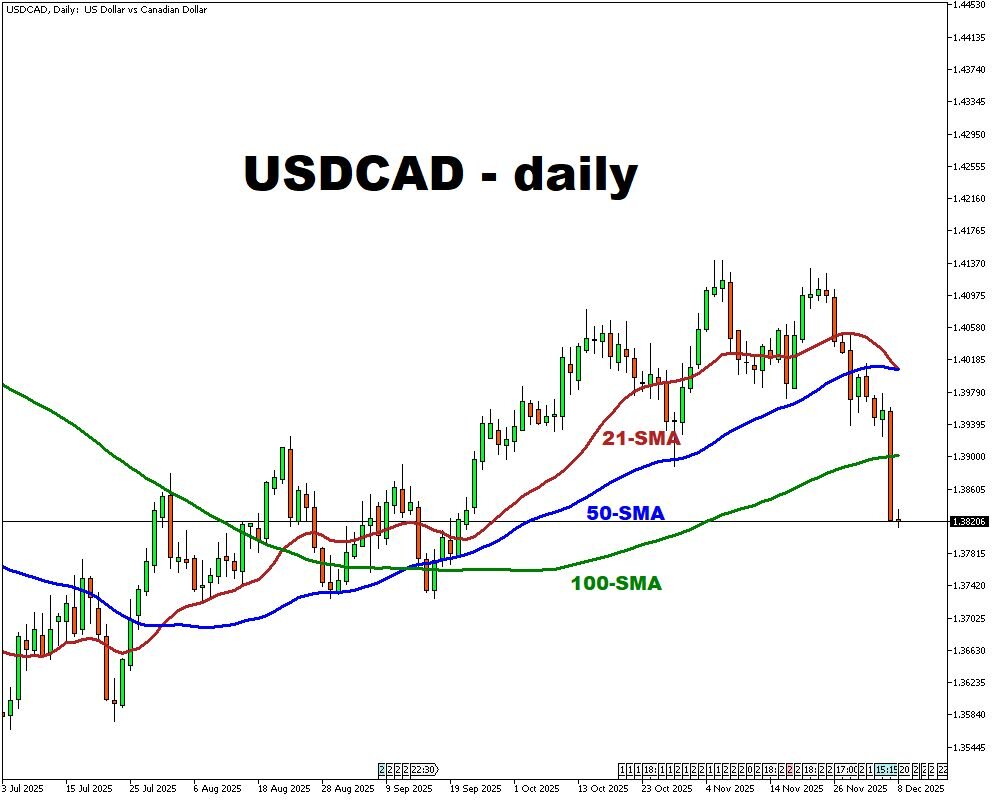

For AUDUSD, the RBA’s Dec. decision follows this year’s three rate cuts that lowered the cash rate to a still-slightly restrictive stance. For USDCAD, the Bank of Canada meets after its recent cut to 2.25%, with growth uneven and inflation nearer target but core measures still sticky, leaving policymakers cautious and unwilling to signal further easing.

For EURUSD, the Fed’s December meeting will shape broad dollar sentiment as markets assess whether a third cut is forthcoming after the September and October moves, or whether policymakers opt for a slower, more data-dependent path.

Events Watchlist:

Tuesday, Dec 9: RBA Interest Rate Decision – AUDUSD

The RBA is expected to hold rates steady, with persistent services inflation and resilient demand likely prompting a slightly firmer tone. A steadier or mildly hawkish message could support AUDUSD, while any suggestion that easing could return may weigh on sentiment.

Wednesday, Dec 10: BoC Interest Rate Decision – USDCAD

The Bank of Canada is widely expected to maintain its stance at 2.25%, emphasizing balanced risks as growth remains choppy and inflation moves closer to target but underlying pressures stay elevated. A cautious or dovish signal could pressure the Canadian dollar, while confirmation that policy is appropriately calibrated may offer some stability.

Wednesday, Dec 10: Fed Interest Rate Decision – EURUSD

The Fed enters the meeting after two cuts this year, with officials cautious about easing too quickly amid uneven inflation progress. A clearly dovish shift may weaken the dollar and support EURUSD, while a more guarded, data-dependent tone could reinforce dollar resilience into year-end.

Other major events this week:

Monday, Dec 8

- CNY: China Balance of Trade (Nov)

- EUR: Germany Industrial Production (Oct)

- CHF: Swiss Consumer Confidence (Nov)

Tuesday, Dec 9

- GBP: BRC Retail Sales Monitor (Nov)

- AUD: RBA Interest Rate Decision; NAB Business Confidence (Nov)

- EUR: Germany Balance of Trade (Oct)

- MXN: Mexico Inflation Rate (Nov)

- USD: US JOLTs Job Openings (Sep & Oct); ADP Employment Change Weekly; Nonfarm productivity (Q3)

- WTI: API Crude Oil Stocks Change (w/e Dec 5)

Wednesday, Dec 10

- CNY: China Inflation Rate (Nov); PPI (Nov)

- USD: Fed Interest Rate Decision; FOMC Economic Projections

- CAD: BoC Interest Rate Decision

- SPN35: Spain Consumer Confidence (Nov)

- WTI: US EIA Crude Oil Stocks Change (w/e Dec 5)

Thursday, Dec 11

- GBP: RICS House Price Balance (Nov)

- CHF: SNB Interest Rate Decision

- CAD: Canada Balance of Trade (Sep)

- USD: US Balance of Trade (Sep); Initial Jobless Claims (w/e Dec 6); PPI (Oct & Nov)

- NZD: New Zealand Business PMI (Nov)

- Brent: OPEC Monthly Report

Friday, Dec 12

- GBP: UK GDP (Oct); Industrial Production (Oct); Manufacturing Production (Oct)

- USD: Fed Goolsbee Speech

- CNY: China New Yuan Loans

Sunday, Dec 14

- JPY: Tankan Large Manufacturers Index (Q4)