This Week: RBA, Eurozone CPI & US Jobs to drive Q4 sentiment

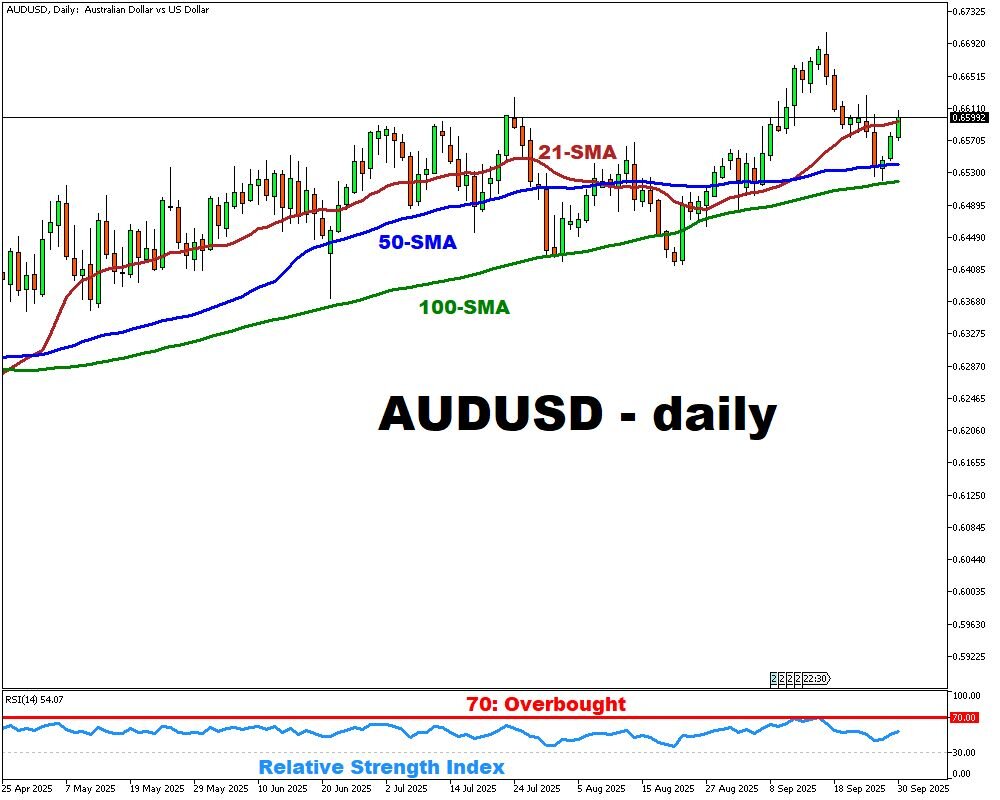

- RBA call: inflation vs growth weighs on AUDUSD

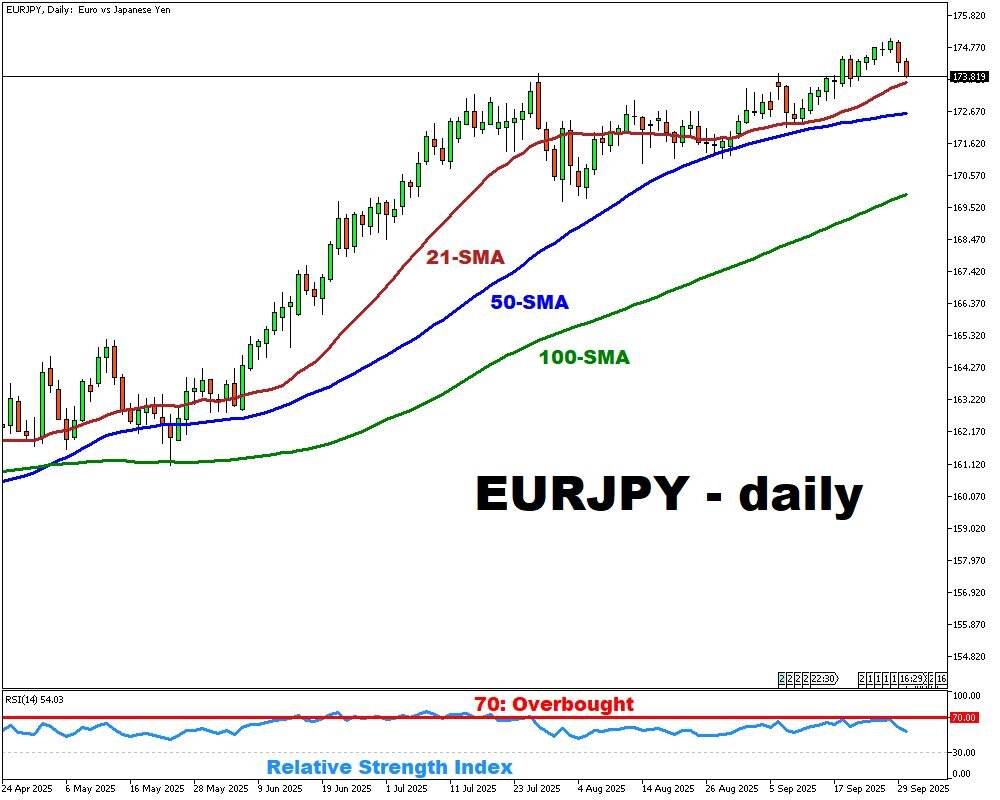

- Eurozone CPI key for ECB stance, EURJPY reacts

- US payrolls guide Fed path, US500 faces swings

- Volatility risk high in AUDUSD, EURJPY, US500

As Q4 begins, three events dominate the calendar: the RBA’s policy call, Eurozone CPI, and U.S. non-farm payrolls. Each will shape rate expectations, currencies, and equities.

Asia-Pacific central banks are still balancing sticky inflation with slowing growth, while Europe’s September CPI will test the ECB’s resolve to stay patient. In the U.S., payrolls remain pivotal for Fed credibility, with job growth, wages, and unemployment guiding the policy path.

Volatility risks are elevated in AUDUSD, EURJPY, and US500 Index as traders recalibrate around shifting global rates.

Events Watchlist:

Tuesday, Sep 30th: RBA Interest Rate Decision – AUDUSD

With inflation ticking up to 3.0% and core measures showing mixed strength, the RBA now faces a delicate balance between inflation risk and softening growth. A neutral or cautious tone would likely support AUDUSD modestly, while renewed easing guidance or explicit dovish bias would put the AUD under renewed downward pressure.

Wednesday, Oct 1st: Eurozone Inflation Rate (Sep) – EURJPY

September CPI will provide another checkpoint for the ECB after three straight months of inflation at target. With headline at 2.0% and core at its lowest since early 2022, markets expect policy to remain steady. A firmer print would lend EURJPY modest support via higher policy expectations, while a softer outcome would reinforce the case for patience and leave EURJPY under pressure.

Friday, Oct 3rd: US Non-Farm Payrolls (Sep) – US500 Index

The jobs trifecta of payrolls, unemployment, and wages remains central to market expectations. A surprisingly strong report would likely erode expectations for aggressive Fed cuts and place downward pressure on the US500. On the flip side, a weak or disappointing print would reinforce a dovish tilt in markets and likely offer a lift to equities amid easing hopes.

Other major events this week:

Monday, Sep 29

- SPN35: Spain Inflation Rate (Sep); Business Confidence (Sep)

- EUR: Eurozone Economic Sentiment (Sep)

- USD: Dallas Fed Manufacturing Index (Sep); Cleveland Fed President Hammack Speech

- JPY: BoJ Summary of Opinions; Japan Industrial Production (Aug); Retail Sales (Aug)

Tuesday, Sep 30

- CNY: China NBS PMIs (Sep)

- AUD: RBA Interest Rate Decision

- EUR: Germany Inflation Rate (Sep); France Inflation Rate (Sep); Germany Retail Sales (Aug)

- CHF: Swiss KOF Leading Indicators (Sep)

- USD: US JOLTs Job Openings (Aug); Chicago Fed President Goolsbee Speech

- JPY: Japan Tankan Large Manufacturers Index (Q3)

Wednesday, Oct 1

- CHF: Swiss Retail Sales (Aug); Manufacturing PMI (Sep)

- SPN35: Spain HCOB Manufacturing PMI (Sep)

- EU50: Eurozone Inflation Rate (Sep)

- US500: US Manufacturing PMI (Sep); ADP Employment Change (Sep)

- WTI: EIA Crude Oil Stocks Change (w/e Sep 26)

Thursday, Oct 2

- AUD: Australia Balance of Trade (Aug)

- JPY: Japan Consumer Confidence (Sep); Unemployment Rate (Aug)

- CHF: Swiss Inflation Rate (Sep)

- EUR: Eurozone Unemployment Change (Aug)

- USD: US Initial Jobless Claims (w/e Sep 27); Factory Orders (Aug)

Friday, Oct 3

- FRA40: France Industrial Production (Aug)

- SPN35: Spain HCOB Services PMI (Sep)

- US500: US Non-Farm Payrolls (Sep); Unemployment Rate (Sep); ISM Services PMI (Sep); Average Hourly Earnings (Sep)