This Week: EURUSD faces key data as august ends.

- Germany Ifo data may sway euro outlook

- Inflation data key for ECB stance signals

- US PCE index to guide Fed policy bets

- Month-end flows could amplify volatility

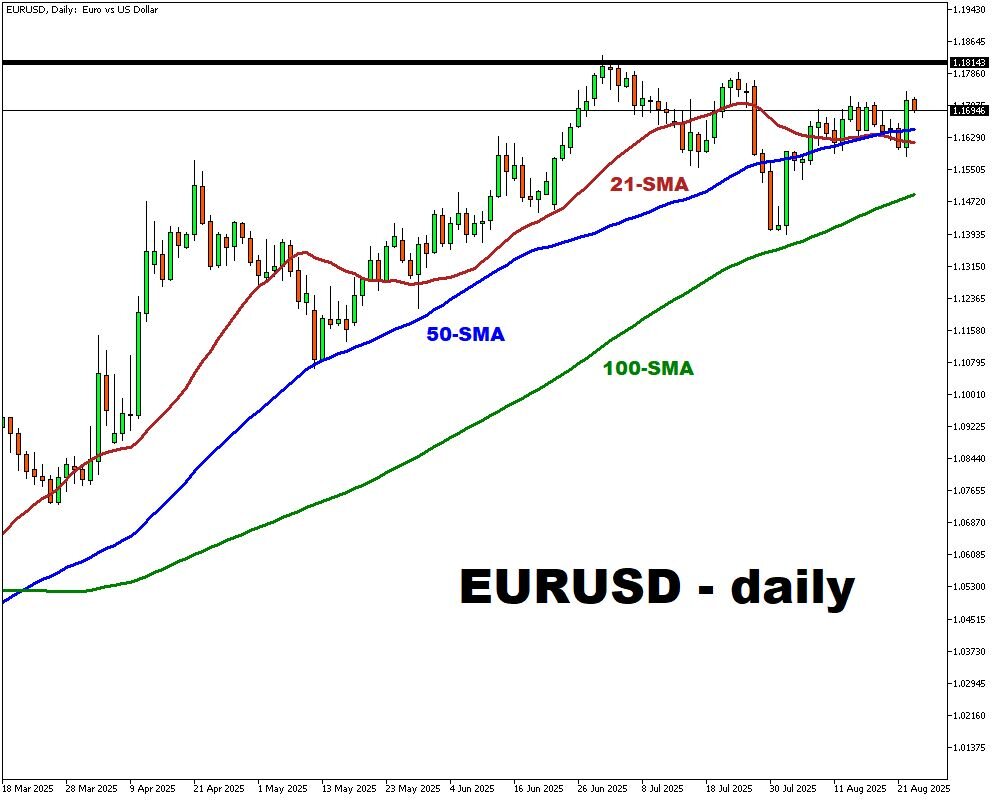

Markets enter the final week of August with EURUSD caught between diverging economic signals from both sides of the Atlantic. Investors are weighing the resilience of US growth against eurozone data. With a cluster of high-impact releases ahead, volatility is expected to remain elevated as traders adjust positions into month-end.

EURUSD is likely to respond swiftly to surprises, particularly from inflation readings and growth indicators that shape central bank outlooks. Short-term swings are anticipated as participants recalibrate to shifting expectations.

Events Watchlist:

Monday, August 25th: Germany Ifo Business Climate (Aug)

This influential sentiment index will provide key insight into German business conditions. A stronger-than-expected outcome could bolster euro confidence and support EURUSD, while weakness may weigh on the pair amid concerns over eurozone growth momentum.

Friday, August 29th: Germany Inflation Rate (Aug)

Inflation remains the central theme for euro positioning. Traders will watch closely for signs of easing or persistent price pressures. A hotter print could push the ECB toward a firmer stance, potentially lifting EURUSD, while softer inflation may reinforce dovish expectations and pressure the euro.

Friday, August 29th: US Core PCE Price Index (Jul)

The Fed’s preferred inflation gauge will be pivotal for dollar direction. A stronger-than-expected reading could fuel expectations of tighter policy, boosting the USD and weighing on EURUSD. Conversely, a softer outcome may offer some near-term support for the euro.