This Week: China Data, UK CPI, US Inflation Focus

- China Q3 GDP tests recovery momentum

- UK inflation key for BoE rate outlook

- US CPI to shape Fed policy direction

- Fragile sentiment drives FX, equities

- Limited data heightens market swings

Global markets head into late October juggling fragile confidence: tentative signs of stabilization in China, sticky inflation pressures in the U.K., and ongoing uncertainty in the U.S., where the government shutdown continues to disrupt key data releases.

With investors forced to navigate patchy macro visibility, this week’s limited but high-impact data points could steer sentiment across equities and FX alike, notably the CHINAH Index, GBPUSD, and EURUSD.

Events Watchlist:

Monday, Oct 20: China Q3 GDP / Industrial Production / Retail Sales – CHINAH Index

Beijing’s Q3 growth data will test whether stimulus and credit easing are taking hold. Q2 GDP rose 5.2% YoY, with Q3 consensus near 5.4%, industrial output at 5.6%, and retail sales at 6.2%. Stronger data could boost the CHINAH Index and Asian equities, signaling firmer domestic demand, while a miss would renew doubts over China’s recovery and pressure regional risk assets.

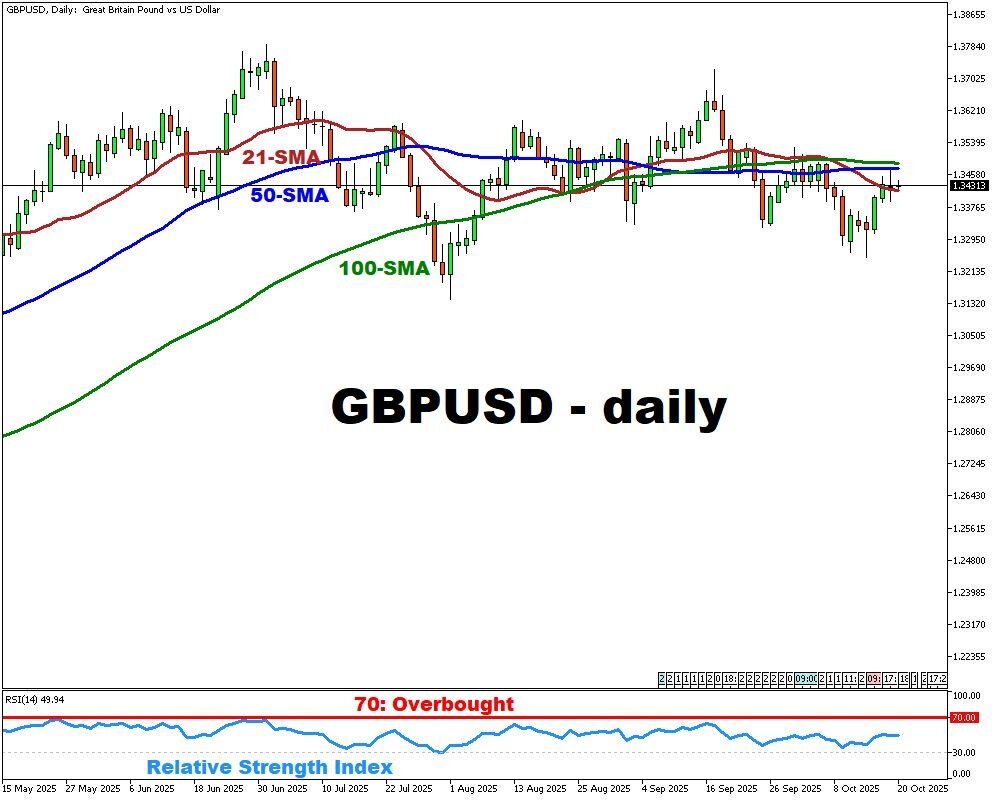

Wednesday, Oct 22: U.K. Inflation Rate (Sep) – GBPUSD

Headline CPI rose 3.8% YoY in August, with forecasts for a slight rise to 4.0%. Persistently high services inflation complicates the BoE’s dovish pivot. A firm print could delay easing expectations and lift GBPUSD, while a softer reading would signal cooling pressures and likely extend sterling weakness into month-end.

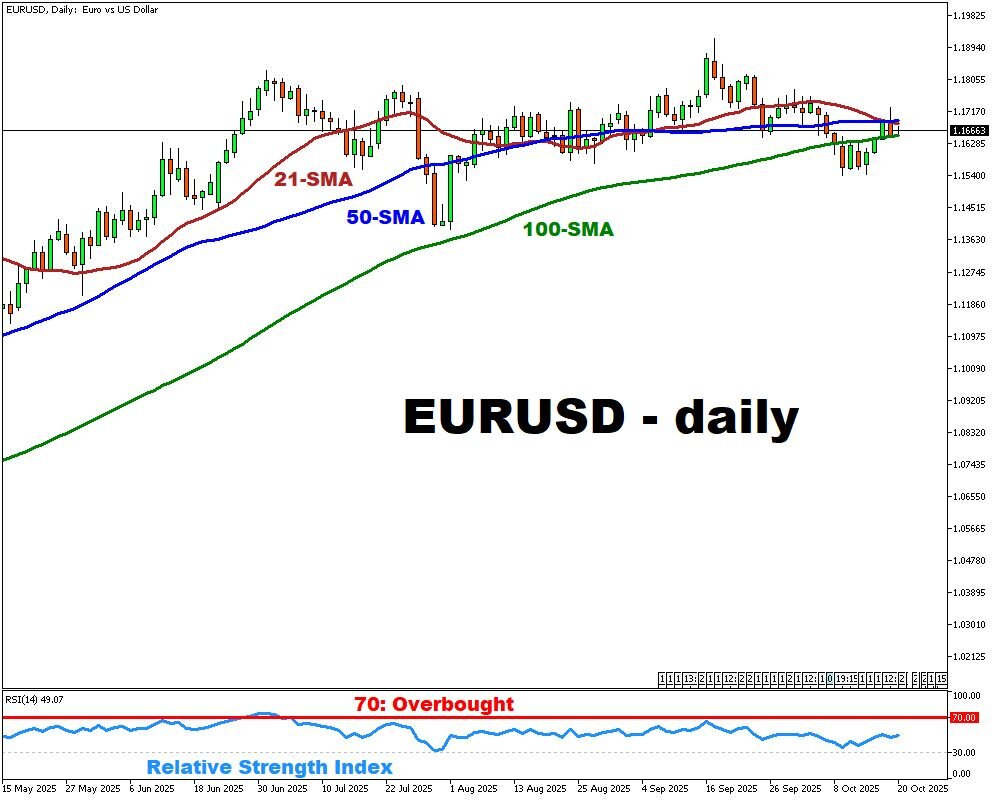

Friday, Oct 24: U.S. CPI (Sep) – EURUSD

The U.S. government shutdown has delayed key data releases, making September’s CPI a crucial inflation gauge. Consensus expects Core CPI at +0.3% MoM / 3.1% YoY and Headline at +0.4% MoM / 2.9% YoY. A soft print would boost Fed rate-cut bets and support EURUSD, while a stronger core would reinforce dollar strength. With limited data visibility, market volatility may rise as traders parse the results carefully.

Other major events this week:

Monday, Oct 20

- NZD: New Zealand Inflation Rate (Q3)

- CNY: China GDP Growth Rate (Q3); Industrial Production (Sep); Retail Sales (Sep)

- JPY: BoJ Takada Speech

- GE40: Germany Producer Price Index (Sep)

- CAD: BoC Business Outlook Survey

Tuesday, Oct 21

- JPY: Japan Balance of Trade (Sep)

- NZD: New Zealand Balance of Trade (Sep)

- AUD: RBA Jones Speech

- CHF: Switzerland Balance of Trade (Sep)

- CAD: Canada CPI (Core & Headline) (Sep)

Wednesday, Oct 22

- WTI: API Crude Oil Stock Change (w/e Oct 17); EIA Crude Oil Stocks Change (w/e Oct 17)

- GBP: UK Inflation Rate (Sep)

Thursday, Oct 23

- AUD: RBA Bulletin

- FRA40: France Business Confidence (Oct)

- SPN35: Spain Balance of Trade (Aug)

- GBP: CBI Business Optimism Index (Q4); CBI Industrial Trends Orders (Oct)

- CAD: Canada Retail Sales (Aug & Sep)

- EUR: Eurozone Consumer Confidence Flash (Oct)

- USD: US Existing Home Sales (Sep); Initial Jobless Claims (w/e Oct 18); Chicago Fed National Activity Index (Sep)

Friday, Oct 24

- AUD: S&P Global Manufacturing & Services PMI Flash (Oct)

- GBP: GfK Consumer Confidence (Oct); UK Retail Sales (Sep)

- JPY: Japan Inflation Rate (Sep); S&P Global Manufacturing & Services PMI Flash (Oct)

- FRA40: France Consumer Confidence (Oct); France HCOB Manufacturing, Services & Composite PMI Flash (Oct)

- ESP35: Spain Unemployment Rate (Q3)

- GER40: Germany HCOB Manufacturing, Services & Composite PMI Flash (Oct)

- EUR: Eurozone HCOB Manufacturing, Services & Composite PMI Flash (Oct)

- GBP: UK S&P Global Manufacturing & Services PMI Flash (Oct)

- CAD: New Housing Price Index (Sep)

- USD: US Core CPI & CPI (Sep); S&P Global Manufacturing, Services & Composite PMI Flash (Oct); Michigan Consumer Sentiment Final (Oct); US New Home Sales (Sep)

- CNY: China FDI (YTD Sep)