This Week: Central Banks Trio and US Jobs (NFP) in Focus

- Big week: RBA, BoE, ECB rate decisions + US jobs

- AUD reacts to RBA's tone Tuesday

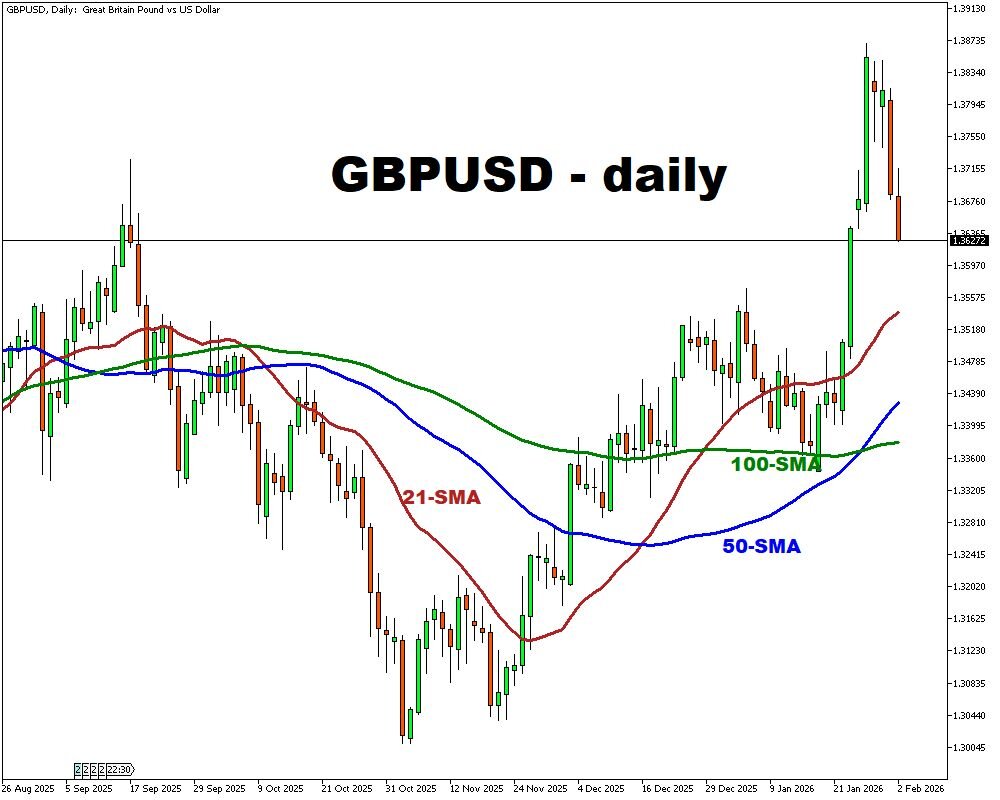

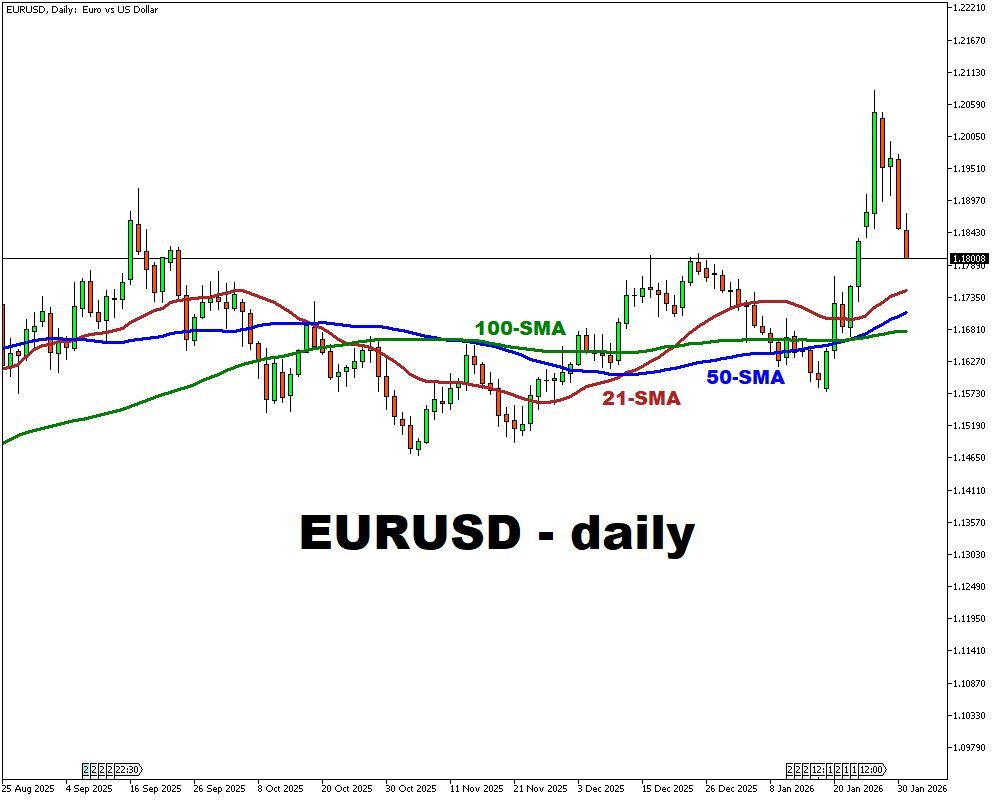

- GBP & EUR move on BoE/ECB guidance Thursday

- USD volatility, Friday hinges on US jobs data strength

- Key earnings this week: Alphabet & Amazon

Markets face a critical week with three major central bank decisions, culminating in the influential US Non-Farm Payrolls (NFP) report on Friday, February 6.

The AUDUSD, GBPUSD, and EURUSD will react to the Reserve Bank of Australia (RBA), Bank of England (BoE), and European Central Bank (ECB) policy signals, with their paths diverging based on inflation and economic growth priorities. The US NFP will then test the dollar's strength against these shifting global rate expectations.

Events Watchlist:

- Tuesday, Feb. 3: RBA Interest Rate Decision – AUDUSD

The RBA is expected to lift its cash rate to 3.85% from 3.60%. With inflation at 3.8%, focus is on guidance. A hawkish rhetoric supports AUD; dovish hints may weaken it.

- Thursday, Feb. 5: BoE & ECB Interest Rate Decisions – GBPUSD, EURUSD

The BoE meets with its rate at 3.75%. A hold is likely, but guidance is key. Dovish signals on future cuts could pressure GBP.

The ECB deposit rate stands at 2.15%. Markets expect guidance on the 2026 cutting pace. Hints of faster easing could weigh on EUR.

- Friday, Feb. 6: US Non-Farm Payrolls (Jan) – USD Pairs

The US jobs report is a major volatility catalyst. Strong job and wage growth could boost the USD by delaying Fed rate cut bets, while a soft report may weaken it.

Other major events this week:

Monday, Feb 2

- CNY: China RatingDog Manufacturing PMI (Jan)

- EUR: Germany Retail Sales (Dec)

- SPN35: Spain HCOB Manufacturing PMI (Jan)

- CAD: Canada S&P Global Manufacturing PMI (Jan)

- USD: US ISM Manufacturing PMI (Jan); ISM Manufacturing Employment (Jan)

- Earnings: Palantir (after market close); Walt Disney (before market open)

Tuesday, Feb 3

- AUD: RBA Interest Rate Decision; Ai Group Industry Index (Jan)

- FRA40: France Inflation Rate (Jan)

- SPN40: Spain Unemployment Change (Jan)

- MXN: Mexico Business Confidence (Jan)

- USD: JOLTs Job Openings (Dec)

- WTI/Brent: US API Crude Oil Stock Change (w/e Jan 30)

- Earnings: AMD (after market close); PepsiCo (before market close)

Wednesday, Feb 4

- CNY: China RatingDog Services PMI (Jan)

- SPN40: Spain HCOB Services PMI (Jan)

- EUR: Eurozone Inflation Rate (Jan)

- USD: US ISM Services PMI (Jan); ADP Employment Change (Jan)

- WTI/Brent: US EIA Crude Oil Stocks Change (w/e Jan 30); EIA Gasoline Stocks Change (w/e Jan 30)

- Earnings: Alphabet (after market close); Ely Lilly (before market open)

Thursday, Feb 5

- AUD: Balance of Trade (Dec)

- GER40: Germany Factory Orders (Dec)

- FRA30: France Industrial Production (Dec)

- GBP: BoE Interest Rate Decision; MPC Meeting Minutes; UK S&P Global Construction PMI (Jan)

- EUR: ECB Interest Rate Decision

- MXN: BoM Interest Rate Decision

- JPY: Japan Household Spending (Dec)

- SPN40: Spain Consumer Confidence (Dec)

- Earnings: Amazon (after market close)

Friday, Feb 6

- EUR: Germany Balance of Trade (Dec); Germany Industrial Production (Dec); France Balance of Trade (Dec)

- MXN: Mexico Consumer Confidence (Jan)

- CAD: Canada Unemployment Rate (Jan); Canada Ivey PMI s.a. (Jan)

- USD: US Non-Farm Payrolls (Jan); Unemployment Rate (Jan); Michigan Consumer Sentiment (Feb)

Saturday, Feb 7

- GBP: UK Halifax House Price Index

Saturday, Feb 8

- JPY: Japan Snap General Election; Japan Current Account (Dec)