This Week: Central banks in focus!

- Major Fed, BoE, BoJ rate decisions shape FX markets

- Fed decision key, driving EURUSD, GBPUSD, USDJPY

- Hawkish Fed strengthens USD, dovish tone weakens

- BoE, BoJ stance pivotal for GBP and JPY direction

Next week brings several key central bank rate decisions, including the Federal Reserve, the Bank of England, and the Bank of Japan. These decisions will have a significant impact on currency markets.

Policy divergence remains the dominant theme: the Fed weighing inflation risks against growth concerns, the BoE contending with sticky UK prices, and the BoJ balancing normalization with a fragile recovery.

The Fed’s decision is likely to be the main driver across markets, with EURUSD, GBPUSD, and USDJPY all primed for outsized moves as traders recalibrate rate expectations.

Events Watchlist:

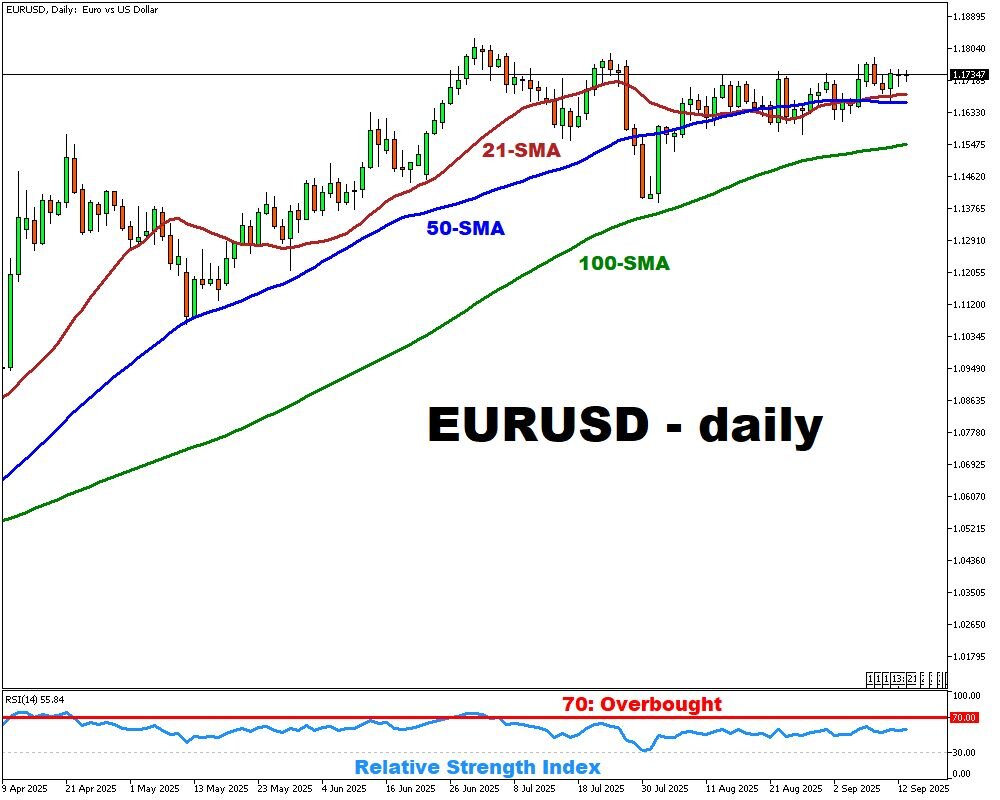

Wednesday, September 17 – Fed Interest Rate Decision: EURUSD

A hawkish Fed stance could reinforce USD strength, driving EUR/USD lower toward the ~1.1602 level. A more dovish shift, with hints at larger cuts, may fuel upside momentum, sending the pair back toward resistance near 1.1830.

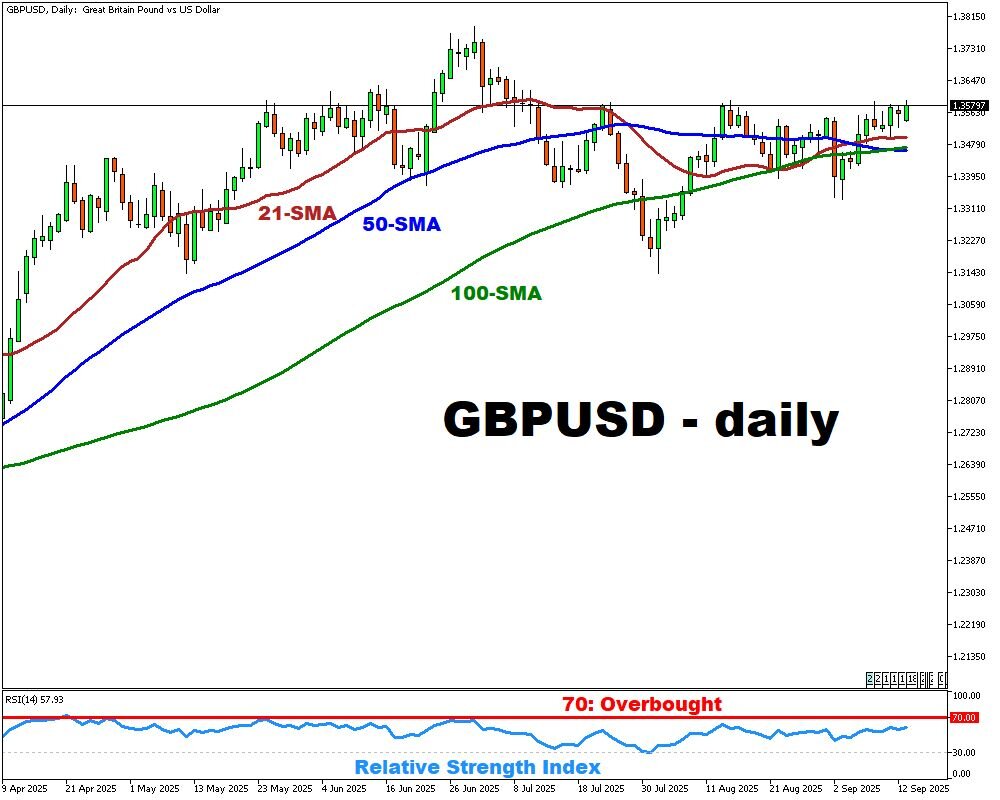

Thursday, September 18 – BoE Interest Rate Decision: GBPUSD

A cautious but firm BoE tone could lift sterling, pushing GBPUSD higher. A dovish stance or stronger emphasis on growth risks, however, would likely weigh on the pound and drive the pair lower.

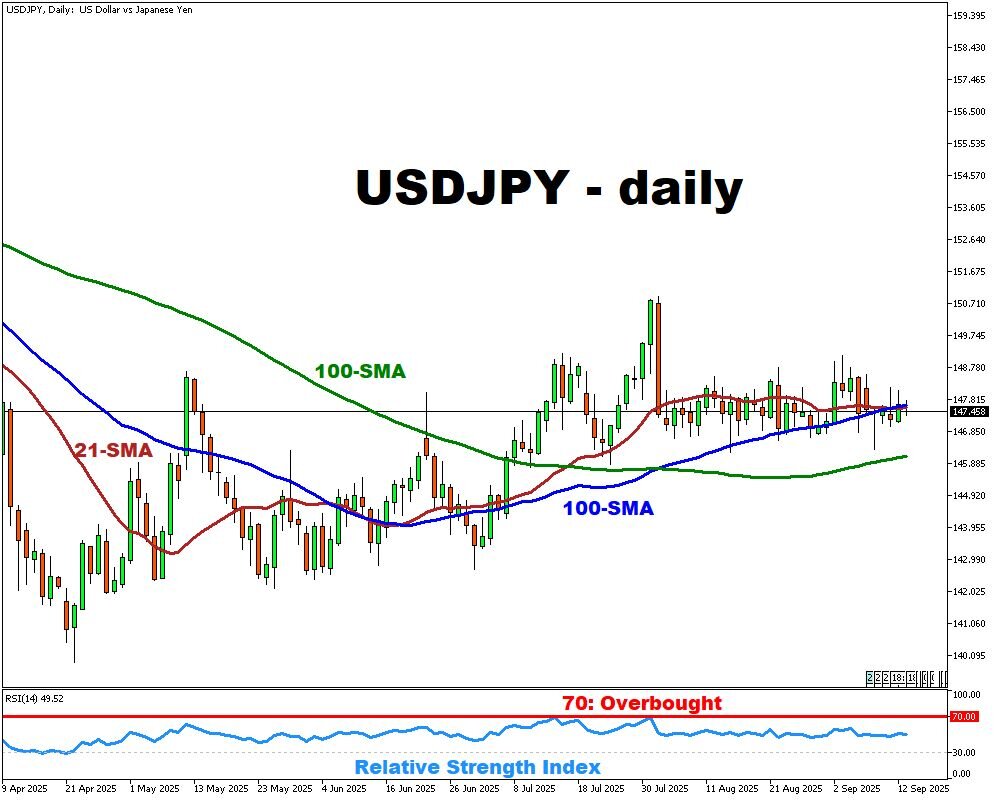

Friday, September 19 – BoJ Interest Rate Decision: USDJPY

If BoJ signals a faster path toward policy normalization, the yen could strengthen, putting downward pressure on USDJPY. However, if Bank of Japan maintains its accommodative stance, USDJPY may be pushed higher.

Here’s a comprehensive list of other key economic data and events due this week:

Monday, Sep 15

· CNY: China Industrial Production (Aug); Retail Sales (Aug); Fixed Asset Investment (Aug)

· GER40: Germany Wholesale Prices (Aug)

· EUR: Eurozone Balance of Trade

· USD: NY Empire State Manufacturing Index

· AUD: RBA Assistant Governor Hunter Speech

Tuesday, Sep 16

· GBP: UK Unemployment Rate (Jul); Average Earnings (Jul); Employment Change (Jul)

· EUR: Germany and Eurozone ZEW Economic Sentiment Index (Sep)

· CAD: Canda Inflation Rate (Aug)

· US500: US Retail Sales (Aug); Industrial Production (Aug); Business Inventories (Jul)

· WTI: API Crude Oil Stock Change (w/e Sep 12)

· JPY: Japan Balance of Trade (Aug)

Wednesday, Sep 17

· AUD: RBA Assistant Governor Jones Speech

· GBP: UK Inflation Rate (Aug)

· CAD: BoC Interest Rate Decision

· USD: Fed Interest Rate Decision

· NZD: New Zealand GDP Growth Rate (Q2)

· JPY: Japan Machinery Orders (Jul)

Thursday, Sep 18

· AUD: Australia Employment Chage (Aug)

· CHF: Swiss Balance of Trade (Aug)

· UK100: BoE Interest Rate Decision

· USD: US Initial Jobless Claims (w/e Sep 13)

· NZD: New Zealand Balance of Trade (Aug)

· GBP: UK GfK Consumer Confidence (Sep)

· JPY: Japan Inflation Rate (Aug)

Friday, Sep 19

· JPY: BoJ Interest Rate Decision

· EUR: Germany PPI (Aug)

· GBP: UK Retail Sales (Aug)

· FRA40: France Business Confidence (Sep)

· CAD: Canada Retail Sales