Silver shift: safe-haven flow meets dollar drag

- Silver rises amid risk-off flows and safe-haven demand

- London market supply crunch deepens the silver rally

- Dollar strength and Fed caution limit upside momentum

- Rate-cut odds at the Federal Reserve fall, hurting precious-metal appeal

- Industrial outlook and data delays add uncertainty to silver’s path

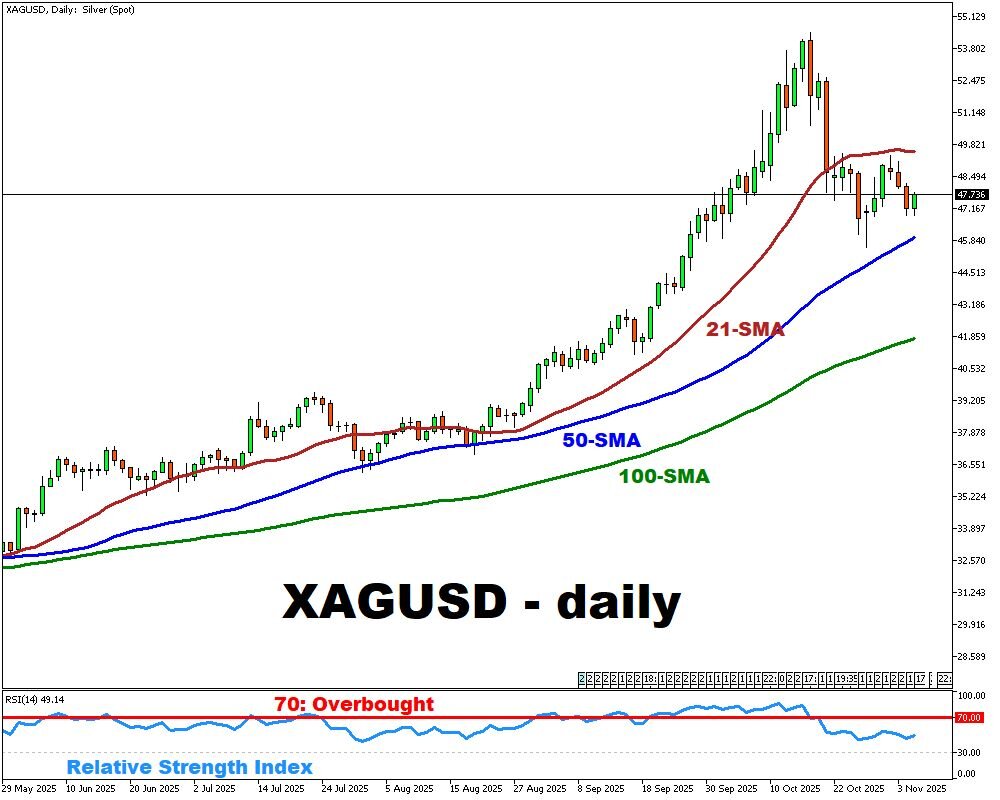

The recent uptick in silver to above $47.5 per ounce can be understood as a convergence of stress and speculative opportunity. Markets are nervous, equities are under pressure, and investors are circling back to so-called safe havens.

A key structural fuel has been the tight physical market in London, where displacement of inventories helped push silver into historically high levels earlier.

On the other side, the dollar has shown strength, which typically works against dollar-priced metals like silver.

At the center of the narrative is the Fed’s policy outlook. Market participants trimmed their odds of a 25 bps cut, an indication that easing might be further off, which reduces attractiveness for non-yielding assets.

The interplay of safe-haven demand, supply mechanics and monetary policy makes the current rally multi-faceted.

Looking ahead, if weak economic prints continue (particularly given disruptions to US data from the government shutdown) silver may benefit further.

But if the dollar strengthens or rate-cut expectations fade further, silver’s rise might stall, especially given analysts’ caution that silver has higher downside risk than gold.