Oil Markets Show Signs of Consolidation

- Brent price: $64.42, target $65.85

- Saudi Aramco: Oil oversupply fears are exaggerated

- IEA forecasts supply surplus

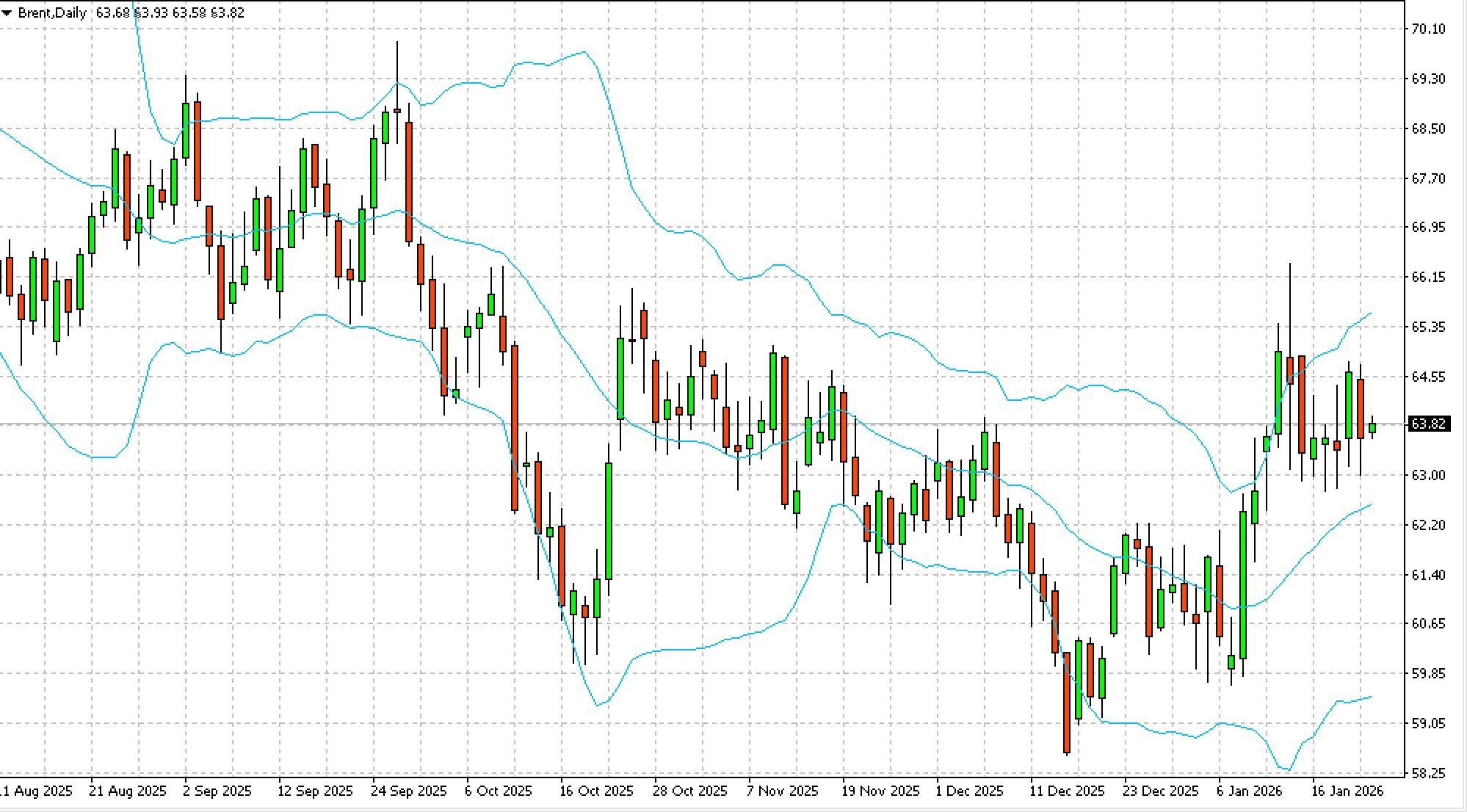

The price of Brent crude oil stabilized near $64.42 per barrel on Friday.

Technically, on the daily timeframe, Brent is still targeting $65.85.

The market is assessing the balance of supply and demand in the global oil market.

The head of Saudi Aramco stated that fears of an oil oversupply are exaggerated, pointing to robust underlying demand from developing economies, primarily China and the United States. According to him, global oil consumption reached record levels last year and is expected to continue growing in 2026.

At the same time, pressure persists from the International Energy Agency (IEA), which reiterated its forecast of a supply surplus over demand for the current year, despite a slight upward revision in its demand growth estimate.

Additional support for prices came from a weakening US dollar, which increased the attractiveness of dollar-denominated commodity assets. However, Brent's gains remain limited amid concerns about rising supply, as well as expectations of a potential softening in the US rhetoric regarding Iran.

For the week, oil prices show moderate growth.