Kiwi firms after RBNZ signals end to easing

- NZD/USD jumps to ~0.5680 – highest in three weeks

- Reserve Bank of New Zealand cuts rate to 2.25% but flags pause

- Market now puts < 20% chance of further cuts next year

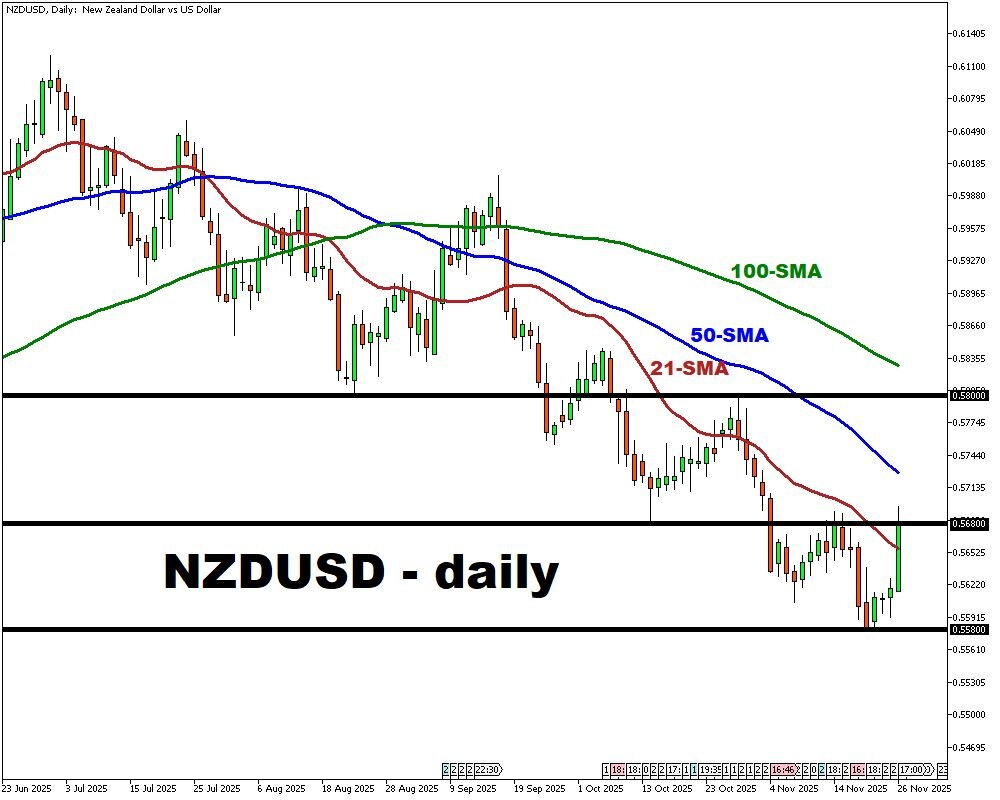

- Technical resistance potentially sits just above 0.5690

- Potential support level – 0.5580

The New Zealand dollar rallied ~1% to trade around 0.568 versus the U.S. dollar after the RBNZ delivered a widely expected 25-basis-point cut to 2.25%, its lowest cash rate since mid-2022.

What surprised markets and fueled the Kiwi’s rebound was the bank’s forward guidance: while rates were lowered, the RBNZ dropped language about further easing and signaled that the current rate is likely to be close to the bottom for now.

As a result, expectations for additional rate cuts next year have fallen sharply with markets now pricing in a less than 20% probability of further reductions.

On the technical front, the surge has pushed NZD/USD close to key resistance near 0.5690.

A decisive break above that level could potentially open the door toward 0.5800. On the flip side, failure to break resistance may potentially see a retreat toward support around 0.5580 or lower.

Markets got the rate cut they expected, but the central bank’s neutral-to-slightly-cautious outlook took away hopes of a further rate-cut continuation.