gold-tumbles-after-rally-on-etf-sell-off-wave

- Falls below $4,100 amid profit taking

- Breaksnine-week winning streak

- ETF outflows deepen market slide

- Fed cuts, trade talks still in focus

- CPI data may steer rate outlook

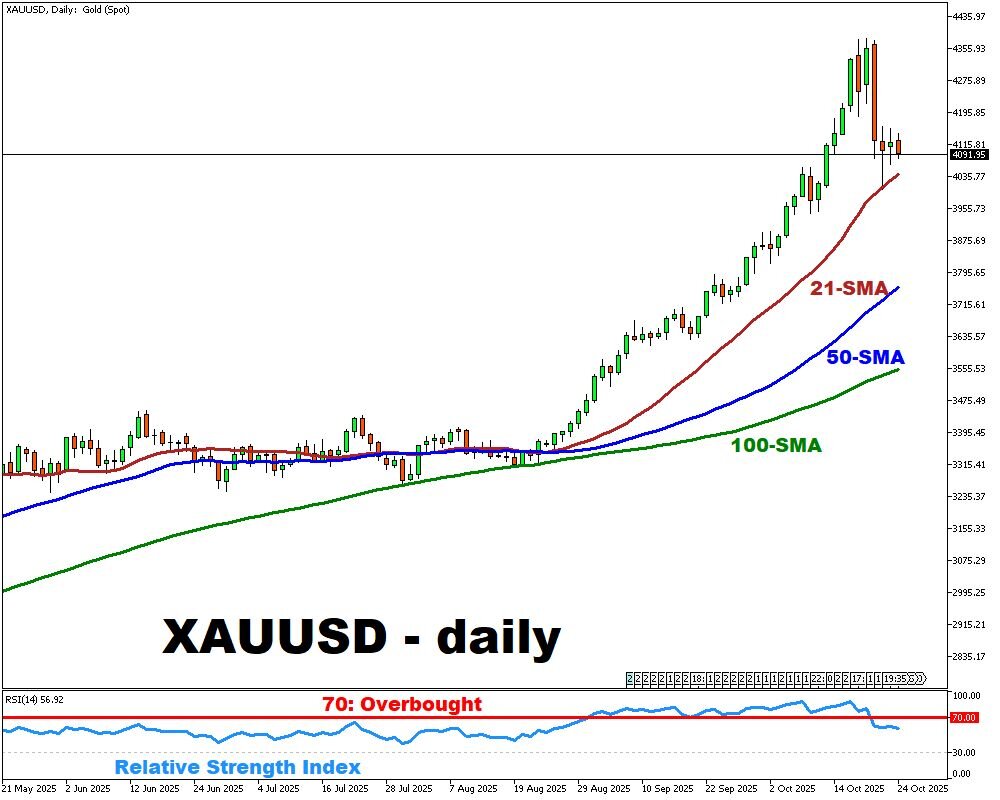

Gold prices retreated sharply this week, falling below $4,100 per ounce on Friday and halting a nine-week winning streak.

The metal suffered its steepest single-day loss in five years earlier in the week, dropping more than 5% as traders booked profits after repeated record highs. The sell-off coincided with notable withdrawals from gold-backed ETFs, which recorded their largest daily tonnage decline in five months, signaling a cooling in investor appetite after months of heavy inflows.

Despite the setback, bullion remains up roughly 65% year-to-date, underpinned by persistent trade frictions and ongoing geopolitical uncertainty.

Markets are closely watching next week’s trade discussions between U.S. President Donald Trump and China’s Xi Jinping, which could influence global risk sentiment. Meanwhile, newly imposed U.S. sanctions on Russia have reignited geopolitical tensions, sustaining some safe-haven demand.

On the monetary front, expectations for two potential Federal Reserve rate cuts before year-end continue to lend structural support, as lower yields make gold more attractive relative to interest-bearing assets. However, stronger-than-expected U.S. inflation data or signs of resilient growth could temper those expectations and pressure prices further.

Investors now await the CPI report later today, which may shape the near-term path for monetary policy and the dollar. Analysts suggest gold could consolidate in a tighter range, with short-term volatility persisting.

For now, gold remains a favored portfolio hedge, though momentum traders are turning more cautious after an extraordinary run-up.