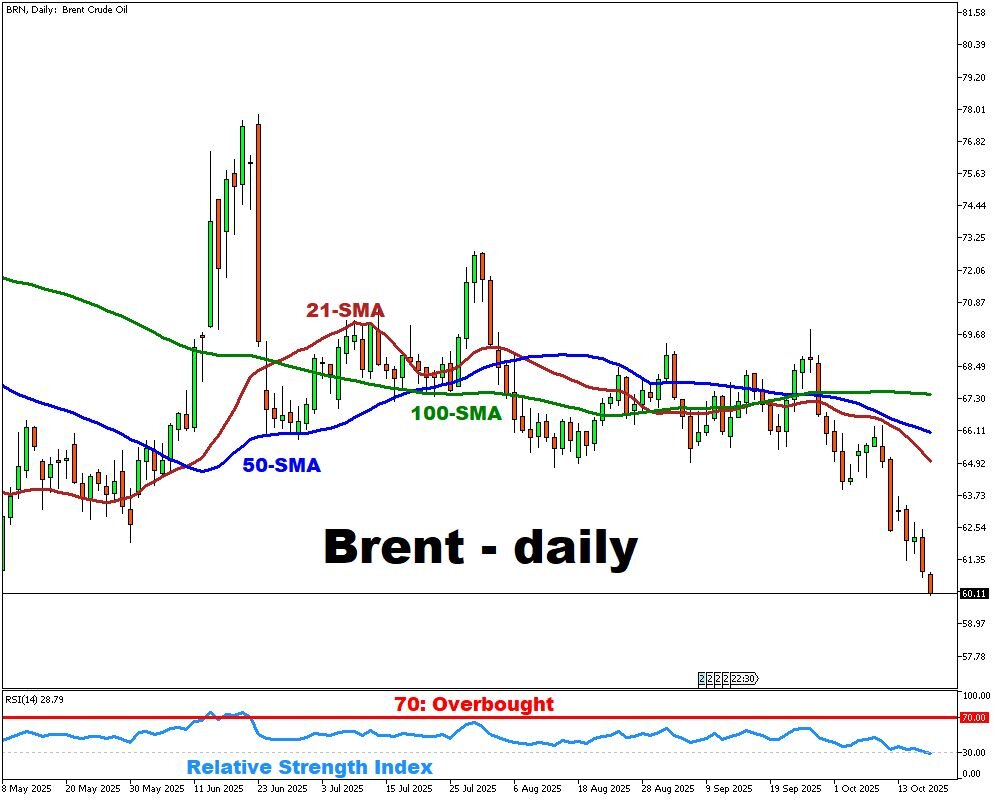

Brent’s slide – geopolitics & oversupply in play

- Prices hit ~5-month low, pushed by supply fears

- Trump–Putin meeting hints easing sanctions

- India signals softened curbs on Russian flow

- US builds 3.5M barrels, demand outlook weak

- IEA sees bigger surplus through 2026

Brent lingered just under $61 per barrel, marking a third straight weekly decline, the longest losing streak since March. Investors appear increasingly focused on the evolving supply narrative, especially against the backdrop of upcoming US–Russia talks that may shift sanctions on Russian oil.

President Trump’s announcement of a planned meeting with President Putin has stirred speculation that a détente could ease export restrictions, potentially flooding the market further. India, one of the largest buyers of Russian crude, added to uncertainty: refiners say they will trim, not stop, imports, awaiting guidance from New Delhi amid US pressure.

On the inventory front, the US Energy Information Administration (EIA) revealed a 3.5 million barrel build, underlining persistent demand softening and heightening concerns about oversupply amid US–China trade tensions. The IEA, meanwhile, revised its forecasts upward, warning of a sustained global surplus through 2026 as output from OPEC+ and non-OPEC producers accelerates.

Market watchers warn of deeper downside. Bank of America sees the potential for Brent to slip below $50, while maintaining a near-term floor at ~$55. The TotalEnergies CEO also cautioned that if prices hover at $60, non-OPEC production growth could begin to fade. Conversely, Goldman Sachs recently nudged its forecast higher for H2 2025 given disruption risks, although it retains a cautious longer-term stance.