Brent nears $66 as sanctions tighten supply

- Brent trades near $66, two-week high

- U.S. sanctions hit Russian producers

- China, India cut Russian oil imports

- EU adds new energy restrictions

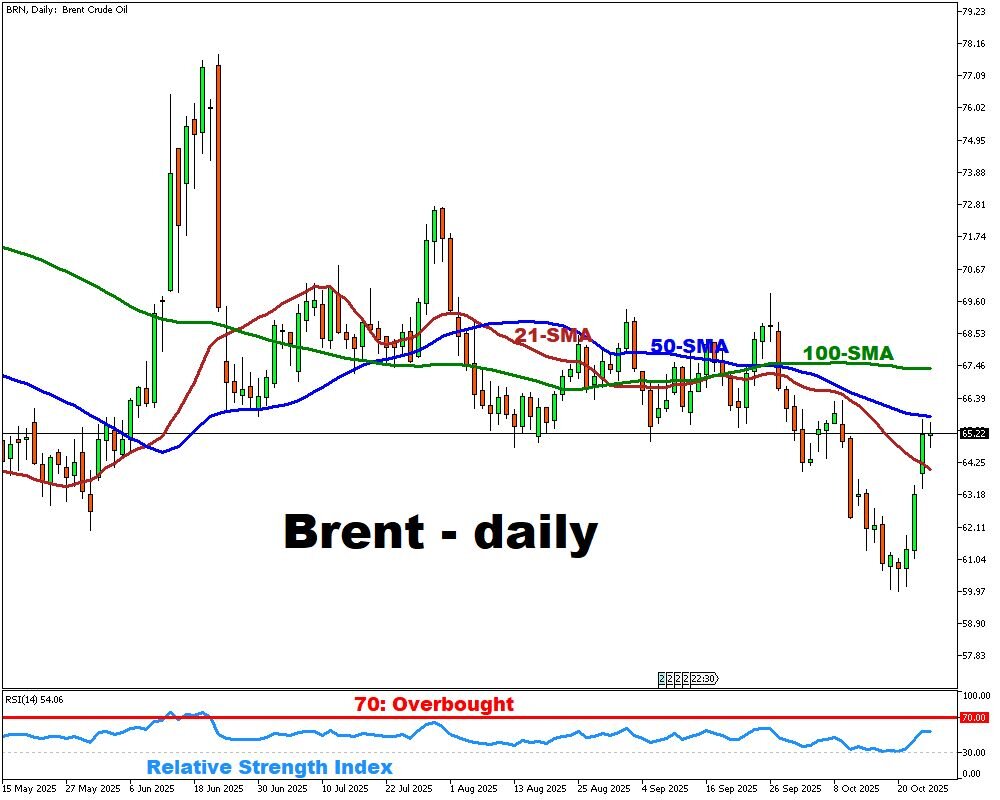

Brent crude futures hovered around $66 per barrel on Friday, holding near a two-week high and heading for their strongest weekly advance since early June.

The surge came after new U.S. sanctions on Russian oil companies intensified supply fears and disrupted the balance of global trade flows. Together, these companies account for nearly half of Russia’s exports, making the restrictions a major blow to the world’s crude market.

Following the measures, Chinese refiners halted seaborne Russian oil purchases, while Indian importers sharply reduced shipments to avoid exposure to potential penalties. This sudden pullback among key buyers amplified expectations of reduced global supply in the near term.

Simultaneously, the European Union introduced broader limits on Russia’s energy sector.

Market indicators show a return to backwardation, where near-term contracts trade at a premium, signaling traders’ belief that supply will remain tight.

Despite this, global demand recovery appears uneven, with slower consumption growth across Europe and parts of Asia. Analysts note that Brent’s next move will hinge on Russia’s ability to reroute exports and on whether OPEC+ adjusts production to stabilize prices.

For now, the interplay of sanctions, trade shifts, and ongoing geopolitical risk keeps Brent in a highly volatile range, underscoring its renewed influence on global inflation and energy security debates.